Authors: dav333, gio6015

Title: Mendi Finance to Continue Using API3 for ezETH Price Data and Benefit from OEV

Type: Request for comments

Abstract

Mendi Finance currently uses API3’s exchange rate feed as a price source for Renzo Protocol’s ezETH/ETH liquid staking derivative (LSD). This proposal wants to incentivize Mendi to continue using the ezETH/ETH dAPI (data feed). In continuing to use the API3 ezETH feed, Mendi will be able to benefit from using data feeds that recapture OEV, where it can be used for the benefit of Mendi - for example, the returned value can be used to improve Mendi staking APY, improving lending rates, or reducing effective liquidation costs. It is suggested that the OEV generated in this initial use case be returned to Mendi stakers to improve staking APY, and prove as a demonstration of the potential value that OEV can bring.

In addition, API3 is growing into a recognisable brand ($500m TVS) synonymous with a new MEV recapture strategy for dApps and their users and can be leaned on to grow Mendi’s market presence.

Snapshot Vote: Snapshot

Proposal Summary

We propose that Mendi continue to use the API3’s exchange rate feed for ezETH. MIP-2 includes switching to Chainlink as an oracle provider for ezETH. This proposal is simply requesting to not switch oracles from API3 to Chainlink, and instead to use ezETH to demonstrate the benefits of OEV data feeds to Mendi.

The OEV generated by this single pair will be returned to the Mendi stakers to improve APY for staking.

Motivation

The efficiency of Mendi can be increased by recapturing value that is being overpaid to third-parties for performing liquidations. It has been proven that liquidations can be so competitive that liquidators are willing to give up over 99.9% of the available revenue. By integrating an oracle solution with an built-in MEV recapture mechanism, Mendi will be able to set itself apart from competitors by generating additional revenue that other protocols are simply leaking away.

Mendi already uses API3’s ezETH price feed on Linea, which makes it the perfect pair to use to demonstrate the value that OEV could bring to Mendi if other data feeds are switched to API3 in future. Technical load will be absolutely minimal to implement this proposal, simply reading from a different proxy contract for the ezETH feed and supplying an address that will be able to withdraw the accumulated OEV from the new proxy contract.

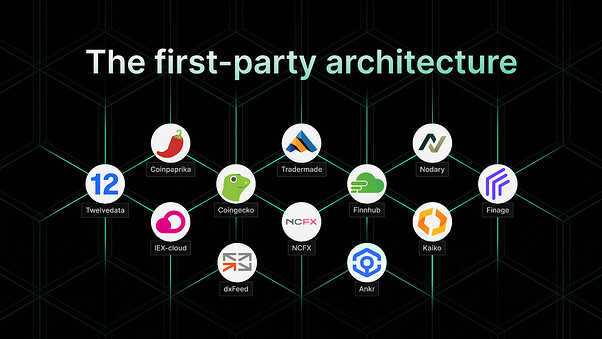

API3’s data feeds (dAPIs) secure over $500m TVS with exchange rate feeds like the ezETH feed are used by a number of dapps, including Init Capital, Lendle, and Pac Finance across 16+ EVM networks, with over 161+ price feeds. Thus, API3 is well positioned for any Mendi chain expansion or concentration plans within and across Linea.

Technical considerations

Mendi is already using the ezETH/ETH exchange rate feed. API3 will deploy a proxy contract to read this feed from that accumulates OEV, and allows Mendi to withdraw it. Mendi would simply need to provide a beneficiary address that is permitted to withdraw the OEV.

As ezETH is an exchange rate feed, it gives the ratio of ETH:ezETH. The underlying price of ETH is still needed to return a dollar value. API3 maintains an ETH/USD price feed on Linea that will be used to supply the price of ETH in USD as well to maximise OEV opportunities. Note that this proposal does not suggest switching from the existing ETH/USD provider for any other markets

Expected Timeline - OPTIONAL

- Governance Vote: {date} (Starts at the posting of the proposal)

- Designation of a beneficiary address: Within 1w of the proposal passing (suggested)

- Switching to OEV proxies: Within 1w of the beneficiary address being created the API3 integration team will share the addresses to read from (suggested)

Designation of a beneficiary address and proxy deployment timelines are flexible for API3, and API3 will work to whatever timelines best suit the Mendi core team, and provide all necessary assistance

Key factors to consider with the proposal

This proposal involves no technical changes, and will improve the APY given to protocol stakers, as well as acting as a proof of the value that using OEV enabled data feeds can bring.

Using API3’s ezETH price feed opens up the potential for Mendi to easily integrate many other LSD price feeds in future, as liquidity for them is bridged to Linea. Examples of the feeds that could be made available instantly for Mendi to use can be seen here.

Conflict of Interest

The authors of this proposal are both contributors to API3 DAO, and Mendi stakers looking to contribute to the newly formed Mendi DAO.

Next Steps

- Provide a beneficiary address able to withdraw the accumulated OEV from a proxy contract

- API3 will then deploy proxy contracts for ETH/USD and ezETH/ETH

- Switch to reading both feeds from the new proxies to determine ezETH/USD

- Once OEV has been accumulated, the Mendi Core team will be able to withdraw it from the proxy using the beneficiary address, and use it to increase APY paid to stakers