Author[s]: Mendi Core Team

Title: The Evolution: Migration to Unified Liquidity Lending

Type: Request for Comment

Link to Snapshot Vote: https://snapshot.box/#/s:mendifinance.eth/proposal/0x8a77ff9832ed4e1511ab4f2b8c6d88e9aa7f5eb91c4beeb2111b7b864c935274

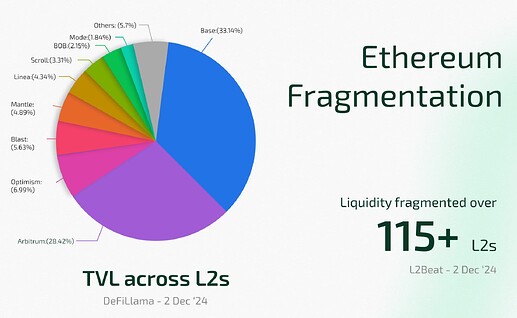

We are embarking on the next chapter of our protocol’s journey, transitioning from a single-chain solution to a Unified Liquidity Lending protocol across Ethereum mainnet and Layer 2s. With this evolution we are aiming to fill in a significant role in DeFi, that expands beyond the Mendi we know today.

Our current single-chain lending protocol has served us well as a foundation, reaching peak TVL of $110+ million and more than half a million users. However, the next phase of growth requires a more ambitious, ground-up re-imagination of a multi-chain solution. To meet the needs of a decentralized world where liquidity and innovation span across Ethereum mainnet and Layer 2s, we will migrate to the unified liquidity protocol that leverages the strengths of our current model while introducing the next generation of lending. The single-chain solution we have today will become the building block of a unified lending protocol that enables us to operate on a much larger scale.

This evolution requires us to grow on multiple fronts to allow the protocol to rise to the challenge and succeed in its next chapter:

- Team: To deliver on the cutting edge tech required for a unified liquidity lending protocol that leverages ZK technology for security, we have been expanding our team and will continue to do so. A larger team, with more diverse skills, particularly expertise in ZK, is enabling us to deliver the complexities of a multi-layered protocol while maintaining high security standards and a seamless user experience.

- Strategic Investment: The vision of a unified future is a novel one that must be pioneered, and investments are a key fuel to make it happen. This capital will enable team expansion and support day-to-day operations, allowing us to further attract top-tier talent and execute a go-to-market strategy that drives significant user adoption. Additionally, it will help fund security measures, such as extensive audits and bug bounty programs; and it will support critical infrastructure costs, such as off-chain computing, to ensure scalability and robustness. To honor the spirit of fair launch, we aim to first extend an exclusive opportunity to Mendi’s most loyal supporters to take part in this pivotal funding event, through a Governance Round. While future strategic investment opportunities are explored.

- Tokenomics: The transition to the unified liquidity lending protocol calls for an enhancement of our tokenomics to effectively attract liquidity, so users benefit from deep pools and efficient markets. As we evolve from a single-chain to a multi-chain environment, it is essential that our token model is designed to maintain competitiveness across all networks. Additionally, the updated tokenomics framework will pave the way for strategic investment, a critical element for paving initial growth, development and audits.

- Brand: Alongside these technical and operational upgrades, we’re launching a new brand that better captures our grander vision and more ambitious goals. This fresh identity marks our growth from a single-chain protocol to a leading force in DeFi, committed to pioneering a unified future. With zkProofs at our core, we’re set to bring secure, scalable, and easy to use solutions to users - all embodied in this new identity.

Creating a Unified Future, powered by zkProofs

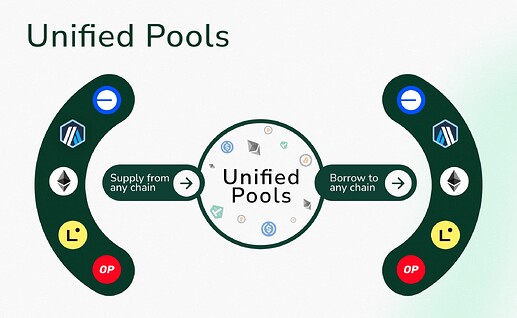

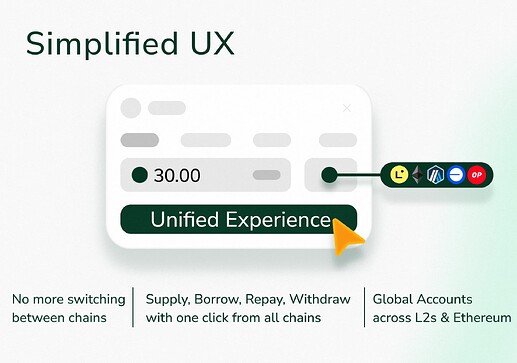

Our Unified Liquidity Lending protocol (detailed in this litepaper) is going to redefine capital efficiency and user experience in DeFi. Users gain access to larger pools, better yields, and a streamlined experience without chain-specific limitations.

- Unified Liquidity: Users can leverage assets from one chain to access opportunities across others, without being confined to a single ecosystem — all from a single unified account.

- Enhanced Capital Efficiency: By accessing a unified pool with globally unified interest rates, users benefit from a more efficient allocation of capital. Instead of fragmenting assets across chains, users can maximize their capital for larger trades and potentially higher returns.

- Secure Protocol Interoperability: ZK Coprocessors at the heart of the protocol, every transaction is verified off-chain and is proven on-chain. This dual-proof setup ensures high levels of security and prevents any missteps in execution, creating a trustless environment.

- Simplified Interactions Across Chains: Thanks to smart contract accounts, users only need to authorize the protocol once, enabling single-click execution across multiple chains without needing to switch between chains.

We envision a DeFi ecosystem where liquidity is truly global, accessible, and unfragmented. With zkProofs as the backbone, our protocol isn’t just aiming to unify liquidity across Ethereum and Layer 2s but also to pioneer a new standard for secure, scalable, and composable financial services. Our ultimate goal is to become a cornerstone of the DeFi ecosystem, fostering liquidity, efficiency and accessibility.

Roadmap

Our roadmap outlines a path to bring the protocol’s vision to reality, with milestones aimed at ensuring steady, scalable growth:

- The Governance Round (Q4/Q1): To support our expansion, we will open a Governance Round exclusively for the Mendi community. Unlike traditional funding rounds dominated by VCs, this round gives Mendi stakers the opportunity to invest directly, ensuring that those who believe in the vision of unified future have a chance to deepen their involvement in its next chapter.

- Testnet (Q4/Q1): With the testnet launch we will be enabling users early access to interact with the protocol, provide feedback, and ensure all features work as expected before mainnet release.

- Mainnet Launch (Q1): To bootstrap liquidity for the Unified Liquidity Lending ****we will launch with a Liquidity Migration, where we incentivize users to migrate their assets to the unified liquidity protocol from Mendi. After establishing a solid liquidity foundation, we’ll move on to Token Migration, with a phased rollout.

- Expansion to More Layer 2s: As we grow, the protocol will continue to integrate major Layer 2 chains, further unifying liquidity across the Ethereum ecosystem, with paramount considerations to security.

- Dynamic Risk Management System: Once unified liquidity lending has successfully established its presence in the market we will introduce a flexible risk management system that offers enhanced borrowing power (ie: higher c-factors) for users with strong on-chain reputations.

- Leverage DeFi Trading: By leveraging increased efficiency of zk off-chain compute, we will be able to implement a secure and scalable decentralized leverage trading product, to increase yields.

New Era, New Tokenomics: Powering Growth

To fully realize the potential of our transition to a unified lending protocol, we must introduce new tokenomics that enable us to secure deep liquidity, drive growth, and remain competitive across all chains.

Liquidity Migration

As part of the protocol upgrade, we are committed to migrating existing Mendi liquidity to the unified liquidity protocol, which will include supplies and borrow positions. To ensure a smooth transition and incentivize participation, we are implementing a double reward system that will bootstrap the protocol’s liquidity from day one.

Users who migrate their positions will receive double incentives:

- $MENDI Rewards

- Points from the Unified Liquidity Lending protocol

These incentives will ensure that we retain a robust liquidity base and pave the growth from the get-go.

Token Migration

The migration is designed to strengthen Mendi and enable to innovate in a secure way by allocating resources to audits, security tools, critical infra costs, liquidity incentives, strategic investments, growth initiatives and development. It focuses on long-term value creation, ensuring $MENDI holders not only retain significant influence in the protocol but also directly benefit from its success as it scales.

The migration of tokens will occur after the initial growth phase of the unified liquidity lending protocol has been successfully achieved and there is sufficient adoption. Until then $MENDI will remain tradable on the market. $MENDI holders will have the opportunity to upgrade their tokens for the new $New_Protocol_Token, at a fixed ratio.

The total supply of $New_Protocol_Token will be capped at 700 million tokens, with 105 million $New_Protocol_Token reserved for $MENDI migrators.

The additional tokens will be dedicated to attracting and establishing deep liquidity across Ethereum and L2s, ensuring active and sustainable markets. In line with our vision, the competitive nature of the market will likely result in a select group of rollups dominating the ecosystem. To position the protocol for the unified future, tokens will also be directed toward strategic investment and team expansion, where raised funds will be used for critical operational needs such as robust security measures, development and marketing. Furthermore, a portion of the tokens will be reserved for providing initial liquidity and driving growth initiatives.

To further incentivize participation, migrators will also receive additional benefits in the form of bonus rewards, these include points in the unified liquidity protocol’s reward system and token rewards for lock-up. Additionally, MENDI holders who migrate will be the first to have their tokens unlocked and access the circulating supply of the $New_Protocol_Token, granting them a first-mover advantage in governance and staking opportunities.

Once the migration is complete, $MENDI will remain tradable, but as the protocol gradually withdraws protocol-owned liquidity (POL), the liquidity of MENDI on secondary markets will become less robust. The USDC part of the POL will moved to the treasury while the $MENDIs will be used as rewards for migrators who lock their tokens.

All migrated $MENDI tokens will be burned, including the core team’s tokens, as well as any unissued and protocol-owned tokens (excluding POL), as a demonstration of the team’s commitment to streamlining the token supply and supporting the protocol’s transition to its next phase. As part of this transition, the core team will receive an allocation of tokens from the new protocol, subject to a 6-month cliff and 2-year vesting schedule, to support team expansion, sustainable growth, and alignment with the project’s long-term vision.

The Governance Round

To fuel our expansion, we are opening a Governance Round. Unlike typical closed rounds that cater only to VCs, we are making this opportunity available to the Mendi community.

The Governance Round is designed to empower our loyal MENDI stakers, giving them the opportunity to actively participate in this crucial funding event. This round allows stakers to invest in the protocol, gaining enhanced governance rights and helping shape the future of the protocol. While we remain open to exploring potential strategic investment opportunities in the future, our primary focus for this round is on strengthening and empowering our dedicated community members. To reward and reinforce the commitment of our community, the vesting period for participants in this round will be determined based on the amount of MENDIs staked.

With community involvement, our goal is to keep the governance truly decentralized, while ensuring that the protocol has sufficient capital to grow in a sustainable and secure manner.